Portfolio Review 2025

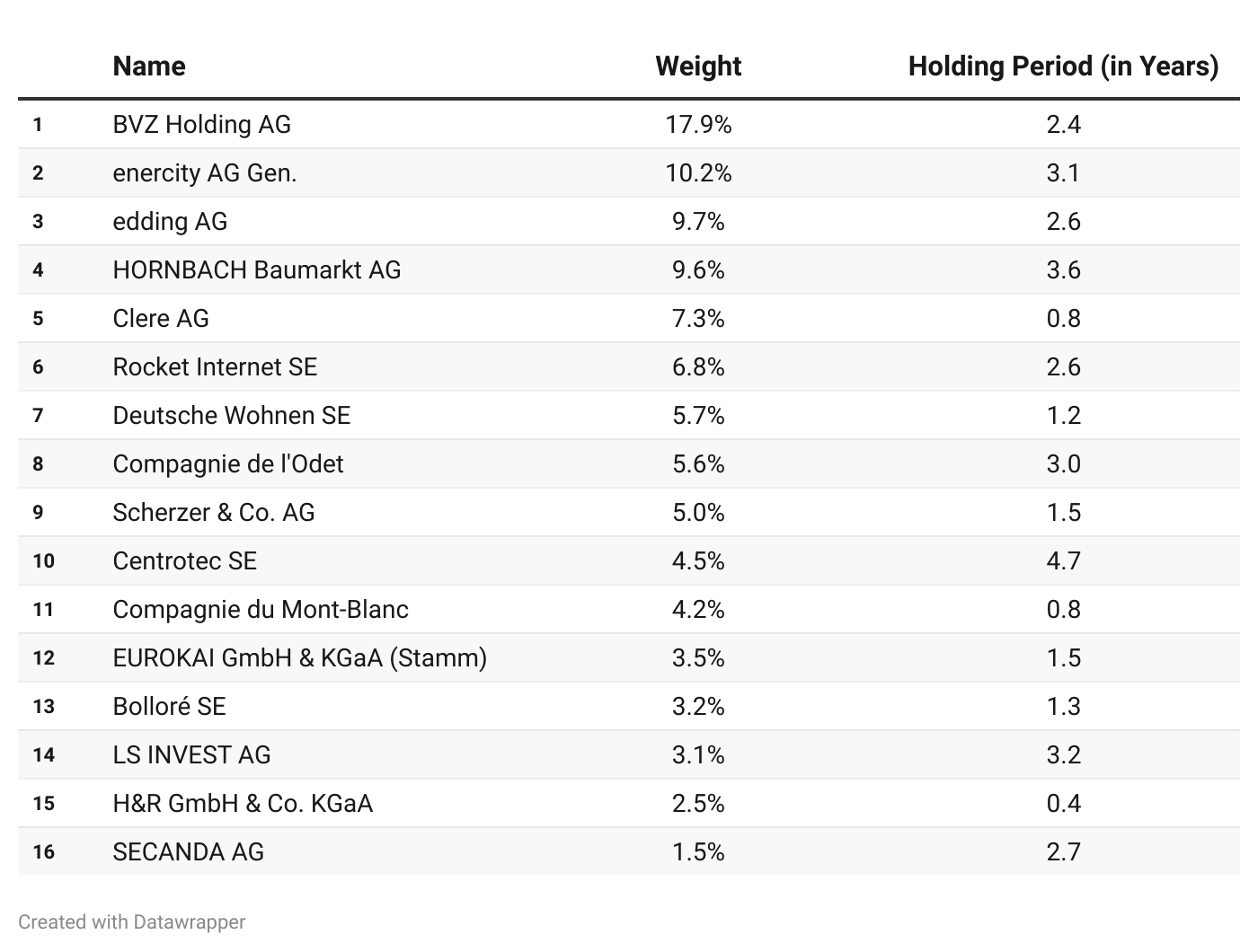

My portfolio gained around 10.5% throughout 2025. The following table shows the current composition.

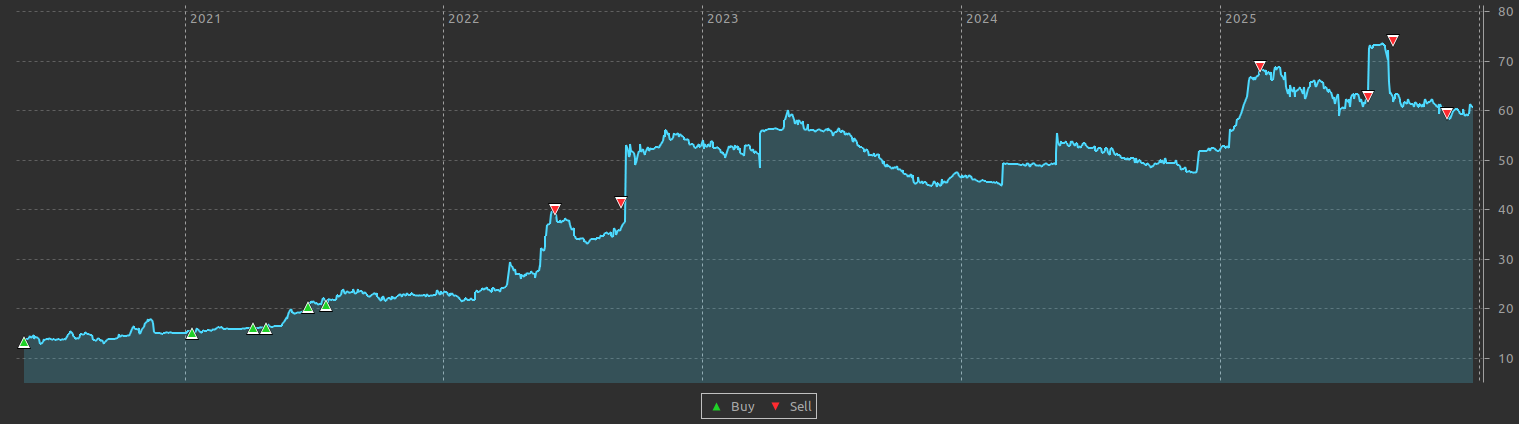

I tried to tender most of my Centrotec shares in the offer this summered but as all investors only got a 10% allocation as Guido Krass also tendered his shares into the offer. As a consequence, I missed the opportunity to sell my position at a price slightly below the offer price via the Hamburg stock exchange (around 74 EUR in comparison to the offer price at 75 EUR). Some fellow investors pointed out the risk of Guido Krass participating in the tender offer but I (falsely) dismissed this risk as unlikely.

Still, after more than four years of being invested in the company, I decided to trim the position and take some further gains of the table. Thus, I sold around 2/3 of my remaining shares in Centrotec in November at a price of around 60 EUR.

Overall, I am very happy with the development of this trade and my corresponding behaviour. I slowly, but continously, increased my position wih increasing conviction, even if this meant increasing my average entry price.

After an increase in price I repeatedly sold smaller parts of the position. I had some bad luck when I sold some shares slightly before Centrotec announced the sale of Wolf to Ariston, but things like these happen. Throughout 2025 I sold more shares as a back of the envelope calculation showed that the price of the tender offer was roughly fair. The trades have an IRR between 22% and 81%.

Up until now, Centrotec was my biggest position for more than four years (at the end of 2022 Centrotec was around 40% of my whole portfolio). With a weight of around 4.5% it is still a considerable part of my portfolio, however, I am certain that I will not buy more shares in the future.

As mentioned in my half-year post, I increased BVZ Holding AG which now is by far my largest position. As already mentioned here, I am very happy with what the company has to offer. As my portfolio is very concentrated on german small-caps, I am happy to have more international diversification with BVZ Holding being a Swiss company. Yet, I keep my eyes open how the entanglement between the Zermatt families might influence the operating results. The announcement to elect Daniel F. Lauber, the son of former BVZ-chairman Daniel Lauber, to the board at the AGM next year is one sign of this network. As mentioned in my long post on BVZ, Daniel Lauber senior has at least one outspoken critic.

The Genussscheine issued by Enercity are a core part of my portfolio and I am looking forward to see how much of the trading volume in 2025 were buybacks of the securities.

I further increased my position in Edding which is slowly but surely consolidating its business ventures and cutting costs. Stationery certainly is no industry whith huge growth potential but I consider the edding brand to be very strong and the financial position of the company is very sound.

My last trade in Hornbach Baumarkt was almost three years ago which makes the stock a solid hold for me. I do not intend to change anything here and am waiting for Hornbach Holding, which continues to increase its position and is above the squeeze-out treshold of 95% since this year, to make its next move.

One thing on my to-do list for 2026 is to attend more AGM. Some likely candidates are Edding in Ahrensburg, Clere in Berlin, Rocket Internet (online). I am also thinking about going to the AGM of BVZ Holding in Switzerland, as I finished the process of getting inscribed in the share registry of the company a few months ago.

Sell

- Centrotec SE (decrease)

- LS Invest (decrease)

- Bauer AG (close)

- Caisse Regionale de Credit Agricole Mutuel de Paris et d’Ile de France CCI (CAF) (close)

Buy

- BVZ Holding AG (increase)

- Deutsche Wohnen SE (increase)

- Rocket Internet SE (increase)

- H&R GmbH Co. KGaA (open)